Some Known Incorrect Statements About Bagley Risk Management

Table of ContentsLittle Known Questions About Bagley Risk Management.Our Bagley Risk Management Ideas5 Easy Facts About Bagley Risk Management DescribedThe Only Guide for Bagley Risk ManagementAbout Bagley Risk Management

This method, if costs do go down listed below that break-even point by the end date, policyholders are secured versus a loss. This is very similar to the method barnyards operate, though they use a traditional bush. As soon as a herdsman contracts their livestock with a feedlot, they hedge those livestock to lock in the revenue point.This will be balanced out by the boosted value of the cattle., breeders secure versus a decrease in the futures board, but do not lose out on the higher return when prices go up.

They do this by picking a lower percent of the predicted ending worth - LRP Insurance. This is an excellent method for those seeking reduced costs rates or who have a greater threat resistance as a result of solid financial wellness. This technique might not protect profitability, but it can protect against significant market drops

There is not a lot of security or insurance coverage on a month-to-month basis, however if there is a serious accident, manufacturers have the satisfaction that comes from understanding they will just be liable for a certain amount expense. Just keep in mind, expect the ideal however get ready for the worst.

Not known Factual Statements About Bagley Risk Management

Using LRP as protection for backgrounded cattle, or livestock on feed, assists minimize that threat by securing the expected value of the pets. Feeder cattle can be hidden to a 900-pound anticipated end weight and fed livestock can be covered up to a 1,400-pound end weight. With a number of weight courses to choose from, it is possible to cover animals with the barnyard to the packer rail.

Applications can take a number of days to procedure and merely loading one out does not secure the applicant into a plan. Once the application is authorized and ready, the LRP recommendation, with its end day and projected finishing worth, can be locked in rapidly. This enables herdsmans to cover calves when the cost is ideal for their market threat administration goals.

Image Politeness USDA-NRCS Rates for calves, feeder livestock and finished cattle have set some new documents this loss and very early winter. A mix of situations has precipitated these historical prices. There is presently a lot of cautious positive outlook on the part of cow-calf producers as they look at the future.

The 7-Minute Rule for Bagley Risk Management

There are some advantages to manufacturers in using LRP insurance coverage as compared to a standard feeder livestock contract or acquisition of an option - Livestock insurance. One is the versatility in the number of cattle that can be guaranteed. There is no reduced limit to the number of livestock that can be guaranteed

There is no obligation to sell livestock on which you have acquired LRP Feeder Cattle protection. You might select to retain ownership and still be qualified for the indemnity must the Actual End Worth fall below your Protection Price. You might market livestock covered by LRP at any moment, provided the transfer of possession does not happen greater than 60 days before the LRP Contract End Day.

If cattle perish and your Ag, Threat Expert is notified within 72 hours of you discovering of the death, the coverage stays essentially, and the manufacturer is qualified for indemnities because of cost loss, even on those animals which died. Yes! Calves can currently be covered prior to hooves hit the ground.

Bagley Risk Management Things To Know Before You Buy

Applications guarantee novice customers can be pre-approved to create an LRP plan It is totally free! Step 2) Lock in an Unique Protection Recommendation (SCE) when you locate a quote that fulfills your goals (Livestock risk protection calculator). Together, we'll secure your Recommended Site financial investment.

With the continuous fluctuation and unpredictability of the market, Animals Threat Protection (LRP) is something all livestock manufacturers need to consider. The main objective of LRP is to shield against the unexpected down rate movement in the industry by setting a base upon any kind of offered day and kind of livestock you desire to insure.

Little Known Questions About Bagley Risk Management.

There are a variety of coverage degree options ranging from 70 to one hundred percent of the expected finishing value (http://go.bubbl.us/df2254/328f?/Bagley-Risk-Management). At the end of the selected insurance coverage duration, if the real finishing value is listed below the protection rate, you will be paid an indemnity for the distinction in price. Producer expects to market 1,000 head of 11cwt cattle and chooses protection of $66

As of 2020, LRP (Livestock) is now offered in all states when the market is offered. Fed Livestock with finishing weights in between 1,000lbs-1,400 pounds that will certainly be marketed for slaughter near the end of the insurance coverage duration.

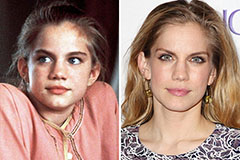

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!